As the title suggests, I am going to explore two claims: that good ideas are valuable, and that their value is increasing.

It’s less common these days to hear the refrain ‘ideas are worthless, execution is everything’. We are all more positive about ideas. And yet, it’s still a challenge to think about how ideas and execution relate.

Derek Sivers famously argued that, ‘Ideas are just a multiplier of execution’. If you’ve got a good idea and don’t execute it, it’s worth nothing. But an average idea well executed is at least worth something. There is of course a literal truth to this, but three things are worth commenting on.

Firstly, while it is true that a good idea not executed is worth nothing, it is worth noting that execution with no idea is also worth nothing.

Let’s imagine we’re sitting in a car, lost.

If we have lots of ideas about where we should go, but never drive, we’ll get nowhere. And if we drive around in circles we’ll get nowhere.

But, secondly, it gets worse than this.

A bad idea, well executed, is much worse that a good idea left idle. Good driving won’t save you if you go over a cliff.

And these costs are not metaphorical. We’ll all have friends who were first up the wrong ladder, companies that successfully completed billion dollar investments that lost more, and nations that successfully conduct never ending war.

Yes, good ideas require execution. But, and this is the overlooked element, execution requires good ideas.

Thirdly, though, the weighting between ideas and execution needs revisiting.

Derek Sivers places ideas on a scale between -1 and 20, and execution on a scale between 0 and 10 million. I think the scales need to be swapped.

Let me give an example from Sydney, where I live.

BridgeClimb runs tours up to the top of the Sydney Harbour bridge (and back again). As you stand on top of one of the world’s most iconic bridges, looking out onto the world’s most iconic harbour, the view is amazing. It is a great business, and a great business idea, but the story of its founding is a story of great execution.

Paul Cave, the founder, was organizing a gathering of the Young Presidents Organisation in Sydney. It included a rarely granted opportunity to climb Sydney Harbour Bridge. Paul Cave thought it would make an obvious but overlooked tourist attraction. To bring this idea to reality took 9 years, $20 million dollars, negotiating with 27 government departments, and 3 acts of parliament. An incredible feat of perseverance and execution.

And the business itself displays incredible attention to detail. As you climb the bridge you are supported by thin metal handrails. Every metre or so the handrail is attached to the bridge with a rivet. Each rivet is numbered. Presumably this means if a tour guide notices a break they can report back ‘rivet CDX45/9 is broken’, rather than ‘about 40 metres after the first turn on the right’.

It’s a great idea, which in turn has become a great business, and is no doubt worth a lot of money (more on this below).

Facebook is another great idea (putting aside for today the complications that arise from that idea), it’s been well enough executed, and is also worth a lot of money. It’s currently worth around US$590 billion.

BridgeClimb isn’t listed and so it’s value is a guess. To make the Maths easier let’s pretend it’s worth around US$295 million. In this equation, Facebook is worth 2,000 times more than BridgeClimb.

There is just no way that Mark Zuckerberg is 2000 times more competent than Paul Cave at executing. Rather, there is something about the idea of Facebook which is more valuable.

In other words, the quality of execution has a smaller impact than the quality of the idea. Execution should be on a scale of 1 to 10, and idea on a scale of 1-10,000. I can hear some saying but for some things execution is everything, to which I would respond, yes, if the idea is not very good, then execution IS everything.

So yes, for a business to be valuable it must have both a good idea and execution, but the idea will have a greater impact. Or to put it slightly differently, find an idea which is so good, that even with average execution, it’s still valuable.

So far, I’ve made a case for why ideas are valuable, but why are they also increasing in value?

Here I’m in debt to James Altucher for the concept of a ‘conspiracy score’. The idea is this. When he assesses new opportunities he asks how many things need to ‘conspire’ in order for the venture to work (hence ‘conspiracy score’). If the opportunity has more than 3 or 4, then he passes. In other words, he asks about the degree of difficulty. Curating lists of great articles is a good idea. Reusing rockets to get into space is a good idea. Reusing space rockets might be a better idea, although it would be easy to underestimate the impact of spreading great articles. But what we can be clear about it reusing rockets is a much harder idea. Every new venture is hard, but as I like to say, not every new venture is ‘got to Mars hard’.

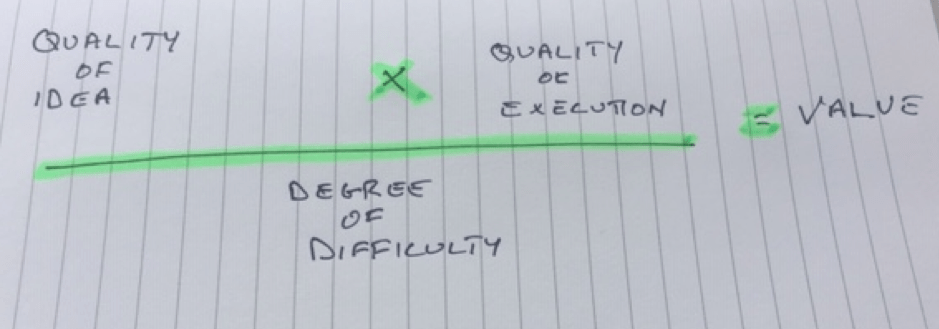

Putting this all together leaves us with a neat little equation for understanding the value of an opportunity.

This last variable, the degree of difficulty, has in recent years, changed significantly.

For some ideas, the conspiracy score has collapsed. Or as Paul Graham noted in a recent tweet, the gap between money and ideas has reduced.

And the easier it gets, the more valuable good ideas become.

This is great news, especially if you have ideas. But there is a little sting in the tail.

Good ideas have not only increased in value, they have become more necessary.

In a world where building a bridge is harder than building a boat, the boat has a fighting chance of winning the contest to get people across a river. But if a boat and a bridge become equally easy, the bridge wins every time.